Financial Modeling for Your New Shoe Company

Financial Modeling For your Shoe Company:

Financial Modeling For your Shoe Company:

Before you send any orders to the shoe factory you need to build your financial models. Financial modeling and cost accounting are important calculations to show if you will make any money! This may sound complicated, but once you have a basic understanding it’s easy. First, you will need to calculate how much it will cost to buy your shoes and import them into your selling market. This is called landing.

FOB or Ex-works Purchase Terms for Shoes :

To build your shoe companies complete financial model, you are going to need to figure out your real product costs. When you negotiate your shoe purchase price, you need to set the purchase terms with the factory. Usually, your price will be quoted as FOB. The FOB price includes the cost to build, package, deliver the shoes by container truck to the container harbor and load the merchandise on the vessel. FOB means you will work with the international shipping lines to move your container and not with a local trucking company. Leave the local trucking price negotiations to the factory.

Another common shoe purchase term is “ex-works.” This means that either you or your freight forwarder are responsible for picking up the shoes from the factory. You may choose to buy your shoes ex-works if you are loading a container with other products.

Another common shoe purchase term is “ex-works.” This means that either you or your freight forwarder are responsible for picking up the shoes from the factory. You may choose to buy your shoes ex-works if you are loading a container with other products.

Landing Costs For Shoes:

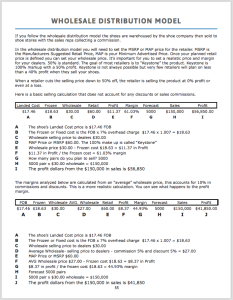

Landing includes all the costs related to moving your shoes from the factory to your warehouse. You need to add in the cost of ocean freight, inland trucking, harbor fees, insurance fees, import duties, document fees, taxes etc. It’s critical to understand these costs, as this will help you work backward from your shoes’ selling price to your factory target price. A shoe which costs $15 FOB will cost closer to $17.46 to buy, ship and import into the USA. The additional inland freight inside your home country could be $.10 to $.50 per pair. This cost will depend on your distribution center’s proximity to the landing port.

If you are using an agent, you may be required to pay duty on the agent’s fees. It’s best to consult your home country’s import regulations. USA regulations require import duty to be paid on any molds or equipment used to make the shoes.

This is a basic calculation of the landed cost. Once you get started, your freight forwarder can help detail other small fees. Some of the costs of the components are under your control, and some are not.

Once you determine the cost to land your shoes, select your sales and distribution business model. You will find footwear sales and distribution models detailed in chapter 8 of How to Start Your Own Shoe Company. Import duty for shoes is reviewed in chapter 5.