Footwear Import Duty Regulations

Was $149 Now $99

Minimize Import Duty Charges and Avoid Costly Errors

To avoid customs clearance delays and costly fees, footwear designers, developers, and brand managers must understand the import duty regulations for shoes. This online course will teach you the footwear classification rules, important HTS codes, and tariff regulations. Lessons include a complete explanation of the footwear classification rules and terminology found in Chapter 64 of the US Government Tariff.

Learn Critical Footwear Duty Classification Rules

Discover how to enhance your product value and increase your profits. “The Shoe Dog” shows you how to avoid costly product duty classifications. Knowledge of duty and tariff classifications will help you design more duty-efficient footwear, avoid common duty mistakes, reduce customs clearance headaches, and pay less to the government while maximizing your footwear profits.

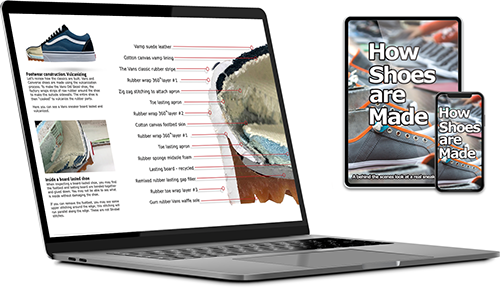

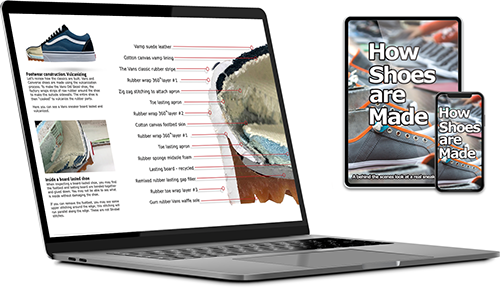

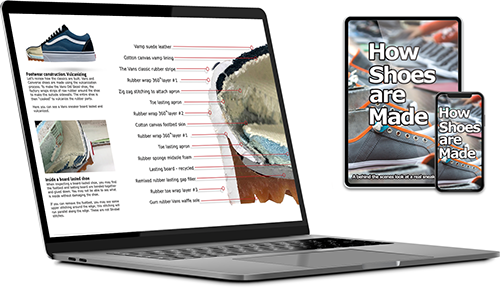

- 5 Lessons on Footwear Duty, HTS, and Classification Rules

- Over 90 minutes of online video instruction with “The Shoe Dog”

- Detailed review of HTS footwear tariff Chapter 64: download included

- Gain inside knowledge of efficient classification from a footwear industry veteran

- Build your footwear classification and import duty reduction skills

- Bonus Content: ebook How to Start Your Own Shoe Company

- Digital Certificate of Completion for the Footwear Import Duty Rules & Regulations Course

The Shoe Dog would like to tell you about this on-line course. Find out if Footwear Import Duty Rules and Regulations Course is right for you.

This course is now included in the All Access Pass!

180 lessons, over 60 hours of on-demand video instruction for shoe designers, developers, and footwear start-ups. Fast-track your footwear career today!

Learn more: Shoemakers Academy All Access Pass.

Yes, you can! All Shoemakers Academy students have access to “The Shoe Dog.” Purchasing an All Access Pass and becoming a Shoemakers Academy VIP entitles you to a complimentary Zoom project review consultation with “The Shoe Dog.” Wade loves to hear from students and fellow shoemakers and personally answers emails daily. We can also set-up additional private Zoom, phone calls, or team coaching sessions to discuss your ongoing needs and keep you moving in the right direction with fewer headaches and costly errors. Email:

Th********@***************my.com